The Great Cloud Vendor War: How Amazon, Snowflake, and Databricks Are Holding Your Data Hostage

Introduction

Your million-dollar data platform could become worthless overnight. While you’ve been busy building pipelines and optimizing queries, the Big Three cloud vendors—Amazon, Snowflake, and Databricks—have been quietly weaving an intricate web of dependencies around your data infrastructure. What started as a battle for market share has evolved into something far more sinister: a calculated strategy to make switching providers so painful and expensive that you’re effectively trapped.

The stakes have never been higher. As data becomes the lifeblood of modern businesses, these platforms aren’t just competing for your subscription fees—they’re fighting for permanent control over your most valuable asset. And they’re winning.

The Anatomy of Modern Data Imprisonment

The Velvet Chains of Convenience

Cloud data platforms didn’t start as prisons. They began as liberation from the tyranny of on-premises infrastructure, promising scalability, flexibility, and cost efficiency. But somewhere along the way, convenience became captivity.

Amazon’s Web of Dependencies Amazon Web Services has mastered the art of gentle entrapment. It starts innocuously—maybe you begin with simple S3 storage because it’s cheap and reliable. Then you add Redshift for analytics, Glue for ETL, and before you know it, your entire data ecosystem is breathing Amazon’s air.

The genius lies in the interconnections. Try extracting your data from this ecosystem, and you’ll discover that your Glue jobs are tightly coupled to S3 buckets, your Redshift clusters depend on VPC configurations, and your Lambda functions are hardcoded with AWS-specific SDKs. Each service becomes another link in an invisible chain.

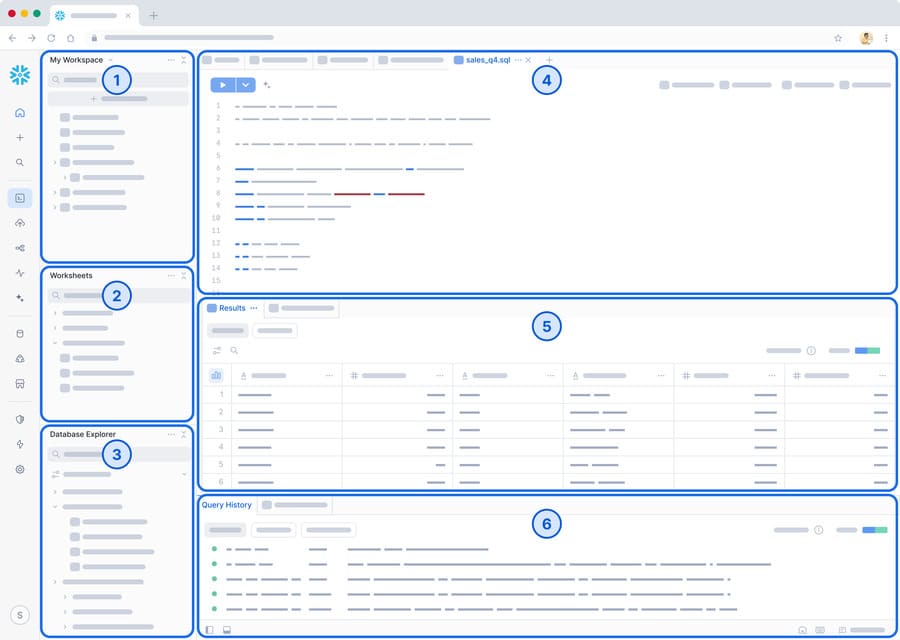

Snowflake’s Seductive Simplicity Snowflake took a different approach: make the platform so elegantly simple that alternatives feel primitive by comparison. Their automatic scaling, zero-maintenance architecture, and SQL-first approach created a generation of data professionals who’ve never had to think about infrastructure.

But this simplicity comes with a price. Snowflake’s proprietary optimizations, unique pricing model, and specialized syntax create subtle but powerful switching costs. Teams become fluent in “Snowflake-speak”—variant data types, result caching strategies, and clustering keys that have no direct equivalent elsewhere.

Databricks’ AI Ambition Databricks positioned itself as the AI-native platform, betting that machine learning workloads would be too complex to easily migrate. Their unified analytics approach, combining data engineering and data science workflows, creates dependencies that run deeper than code—they embed themselves in organizational processes and team structures.

The Hidden Architecture of Lock-in

Modern vendor lock-in isn’t built through explicit restrictions—it’s architected through a thousand small conveniences that compound into massive switching costs.

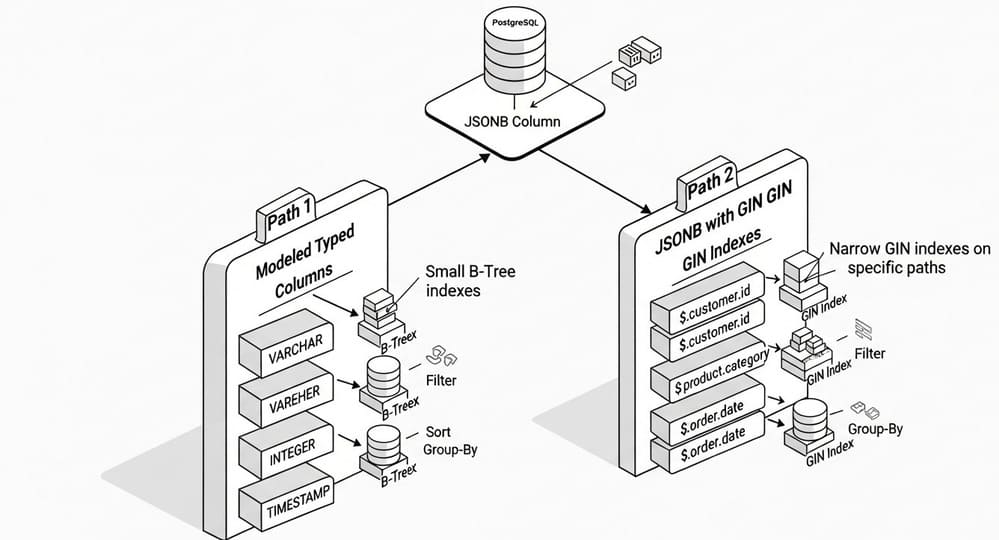

Format Fragmentation Each platform pushes proprietary optimizations:

- Snowflake’s micro-partitions and automatic clustering

- Databricks’ Delta Lake format and Unity Catalog

- Amazon’s Redshift Spectrum and compressed columnar storage

While these features deliver real performance benefits, they also create data formats that don’t translate cleanly between platforms. Your optimized Snowflake tables become expensive migration projects when moving to Databricks.

Integration Interdependencies The platforms excel at playing nice with each other—until you try to leave. Snowflake’s native connectors work seamlessly with AWS services but struggle with GCP equivalents. Databricks’ MLflow integrates beautifully within their ecosystem but becomes clunky when interfacing with external platforms.

Skill Set Specialization Perhaps most insidiously, each platform creates specialized skill sets. Data engineers become “Snowflake experts” or “Databricks specialists,” carrying institutional knowledge that becomes harder to replace if you switch platforms. The human capital investment becomes part of the lock-in strategy.

The Price of Freedom: Understanding True Switching Costs

Beyond the Sticker Price

When evaluating cloud platforms, most organizations focus on compute and storage costs—the visible portion of the iceberg. The real expenses lurk beneath the surface.

Data Migration Complexity Moving petabytes of data isn’t just about bandwidth costs (though those can reach six figures). The real expense lies in:

- Schema translation and optimization

- Performance regression testing

- Downstream application updates

- Historical data reformatting

Retraining and Productivity Loss A team of 10 senior data engineers earning $150K annually represents $1.5M in salary costs. If switching platforms reduces their productivity by 30% for six months during the transition, you’re looking at $225K in hidden costs—before accounting for delayed projects and missed deadlines.

Application Refactoring Modern data platforms aren’t just databases—they’re application platforms. Business intelligence tools, automated pipelines, and machine learning workflows all contain platform-specific optimizations that need rebuilding, not just reconfiguring.

The Gotcha Pricing Phenomenon

Cloud pricing has evolved into a psychological warfare designed to obscure true costs until you’re too deep to escape easily.

Snowflake’s Consumption Trap Snowflake’s “pay-for-what-you-use” model sounds reasonable until you discover that “what you use” includes:

- Automatic clustering that runs without explicit requests

- Result caching that consumes compute credits

- Background maintenance tasks that spike unexpectedly

- Cross-region data transfer fees that weren’t in the original estimate

Databricks’ Feature Upselling Databricks’ tiered pricing structure leads organizations down a predictable path:

- Start with the Standard tier for basic workloads

- Discover you need Premium for role-based access control

- Upgrade to Enterprise for advanced governance features

- Add Unity Catalog for compliance requirements

Each upgrade comes with significant cost increases and deeper platform dependencies.

AWS’s Death by a Thousand Cuts Amazon’s a-la-carte pricing model creates bills that resemble itemized restaurant receipts. Data transfer between availability zones, API calls, storage requests, and dozens of micro-services each carry individual charges that compound into substantial unexpected costs.

The Open Source Rebellion: Apache Iceberg and the Fight for Freedom

The Liberation Movement

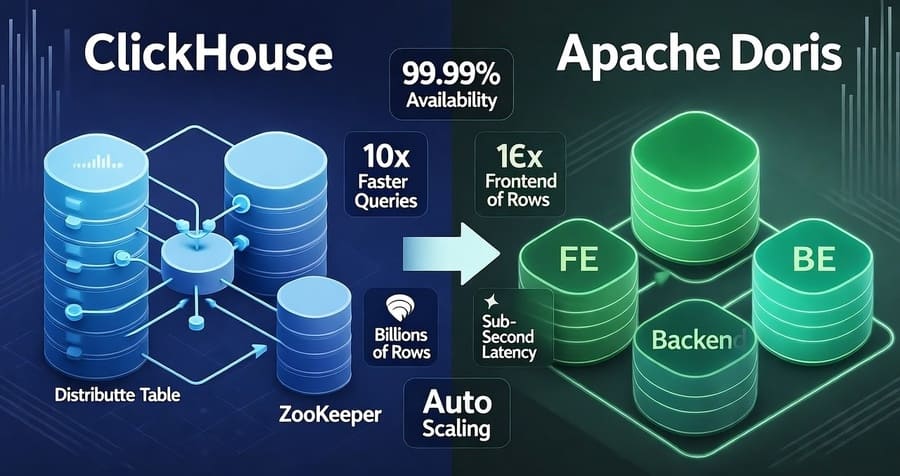

While the Big Three tighten their grip, a quiet revolution brews in the open-source community. Apache Iceberg, Delta Lake (now fully open-sourced), and Apache Hudi represent more than just table formats—they’re declarations of independence.

Apache Iceberg: The Great Equalizer Iceberg’s genius lies in its platform agnosticism. By creating a universal table format with advanced features like schema evolution, time travel, and partition evolution, it enables the same data to be accessed efficiently by multiple compute engines.

Suddenly, your data isn’t trapped in Snowflake’s micro-partitions or Databricks’ Delta format. It lives in a truly open format that Spark, Trino, Flink, and even proprietary engines can read with equal efficiency.

The Multi-Engine Renaissance Open table formats enable a “best-of-breed” approach:

- Use Spark for complex transformations

- Query with Trino for interactive analytics

- Stream process with Flink for real-time workloads

- Visualize with any BI tool

This architectural flexibility fundamentally undermines the platform lock-in strategy.

The Vendor Response: Embrace, Extend, Extinguish?

The Big Three haven’t ignored the open-source threat. Their responses reveal both the power of open formats and the lengths vendors will go to maintain control.

Snowflake’s Iceberg Integration Snowflake announced read-only support for Apache Iceberg, allowing customers to query Iceberg tables stored in object storage. But notice the limitations: read-only access and subtle performance differences that nudge users toward native Snowflake tables for write-heavy workloads.

Databricks’ Delta Lake Gambit Databricks open-sourced Delta Lake but maintains tight control over Unity Catalog, their governance layer. You can use Delta format anywhere, but the advanced features that make it enterprise-ready remain tied to the Databricks platform.

AWS’s Neutral Positioning Amazon plays a different game, positioning AWS Glue as the “neutral catalog” that works with any format. But this neutrality comes with its own form of lock-in—deep integration with AWS services that becomes difficult to replicate elsewhere.

Multi-Cloud Fantasies vs. Reality

The Promise vs. The Practice

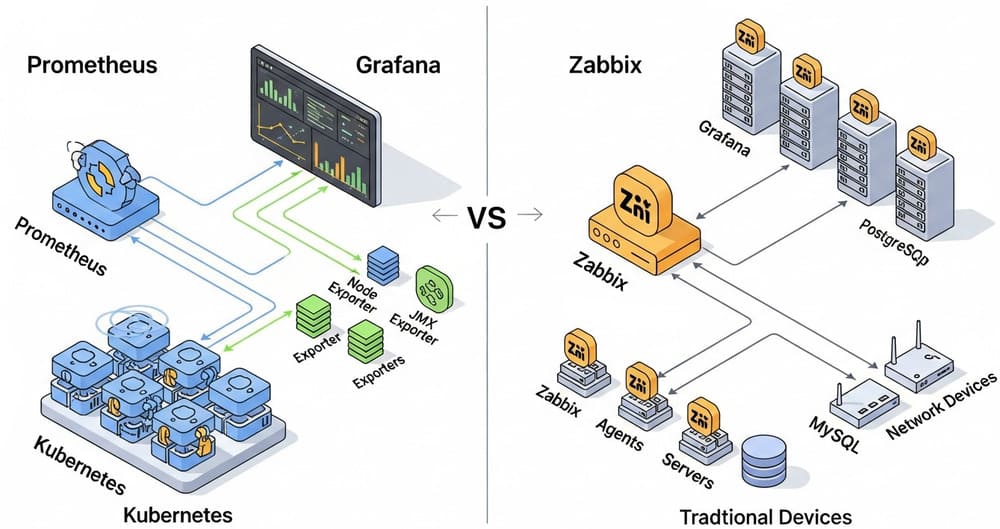

Multi-cloud strategies sound brilliant in boardrooms: avoid vendor lock-in, optimize costs across providers, maintain leverage in negotiations. The reality proves far more complex.

The Integration Nightmare Each cloud provider optimizes for their own ecosystem. Simple tasks like data replication between AWS S3 and Google Cloud Storage become exercises in:

- Managing different authentication systems

- Handling inconsistent APIs

- Monitoring across multiple dashboards

- Reconciling different service level agreements

Cost Optimization Complexity While multi-cloud theoretically enables cost optimization, the operational overhead often exceeds the savings. Teams need expertise across multiple platforms, monitoring tools multiply, and the complexity of cost allocation makes accurate ROI calculations nearly impossible.

The Skills Multiplication Problem Multi-cloud doesn’t just double your complexity—it multiplies it exponentially. A team that masters Snowflake and Databricks isn’t just learning two platforms; they’re learning:

- Two different SQL dialects

- Two security and governance models

- Two optimization strategies

- Two troubleshooting methodologies

- Two vendor support systems

When Multi-Cloud Makes Sense

Despite the challenges, certain scenarios justify multi-cloud complexity:

Regulatory Requirements Some industries require data residency in specific regions or with particular providers for compliance reasons. Financial services might use AWS for general workloads but require specialized GCP services for specific regulatory reporting.

Best-of-Breed Specialization Certain providers excel in specific areas:

- Google’s AI/ML capabilities for advanced analytics

- AWS’s breadth for general-purpose computing

- Snowflake’s ease-of-use for business intelligence

Risk Mitigation for Critical Workloads For mission-critical applications where downtime costs exceed operational complexity, redundant multi-cloud deployments can provide ultimate availability insurance.

The Hidden Costs of Platform Switching

Technical Debt Accumulation

Every day you remain on a proprietary platform, you accumulate technical debt in the form of platform-specific optimizations. This debt compounds over time, making eventual migration increasingly expensive.

Query Optimization Debt Performance optimizations become handcuffs. Those Snowflake clustering keys that improved query performance by 10x? They’ll need complete reimplementation on Databricks. The carefully tuned Databricks cluster configurations? They’re meaningless in BigQuery’s serverless environment.

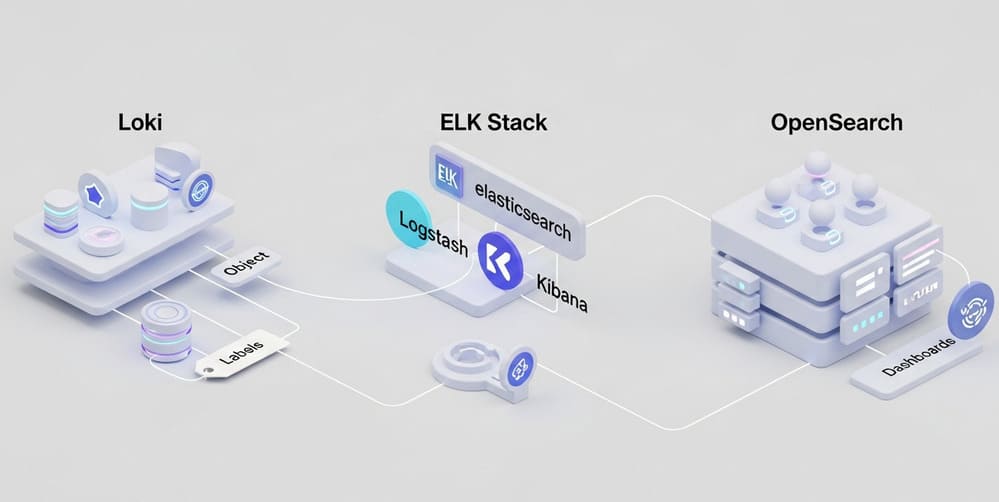

Workflow Integration Debt Modern data platforms integrate with hundreds of third-party tools. Each integration point becomes a potential friction point during migration:

- dbt models with platform-specific syntax

- Apache Airflow DAGs with proprietary operators

- BI tools with platform-specific optimizations

- Monitoring solutions with custom metrics

Organizational Process Debt Perhaps most costly, teams develop processes around platform limitations and capabilities. Snowflake teams develop different data modeling patterns than Databricks teams. These organizational differences persist long after technical migrations complete.

The Psychology of Sunk Costs

Platform switching isn’t just a technical decision—it’s a psychological challenge that confronts the sunk cost fallacy at an organizational level.

Investment Justification After investing millions in a platform, acknowledging that you need to switch feels like admitting failure. This psychological barrier often keeps organizations trapped long after the rational decision would be to migrate.

Career Risk Assessment Individual decision-makers face personal career risks. The executive who championed Snowflake adoption isn’t eager to announce that Databricks would better serve the organization. These human factors often outweigh technical considerations.

Breaking Free: Strategies for Platform Independence

The Open Architecture Approach

Smart organizations are designing for optionality from day one, building architectures that minimize switching costs and maximize flexibility.

API-First Integration Instead of using native platform features, design integrations through well-defined APIs. This abstraction layer makes switching platforms primarily a configuration change rather than a code rewrite.

python# Bad: Platform-specific implementation

snowflake_connection = snowflake.connector.connect(

user='username',

account='account_name',

warehouse='compute_wh'

)

# Better: Abstracted implementation

data_warehouse = DataWarehouseFactory.create(

provider=config.WAREHOUSE_PROVIDER,

connection_params=config.CONNECTION_PARAMS

)

Standard SQL Adherence While each platform offers proprietary extensions, disciplined teams can achieve 80% of their functionality using standard SQL. This approach sacrifices some optimization for portability.

Open Format Strategy Store data in open formats (Parquet, Iceberg, Delta) even when using proprietary platforms. This ensures your data remains accessible regardless of compute layer changes.

The Negotiation Advantage

Platform independence isn’t just about technical architecture—it’s about maintaining negotiating leverage.

Credible Exit Threats Vendors take pricing negotiations more seriously when they know you can actually leave. Organizations with portable architectures often secure better terms than those obviously trapped.

Competitive Benchmarking Regular proof-of-concept exercises on alternative platforms provide concrete data for cost and performance comparisons. This intelligence proves invaluable during contract renewals.

Feature Request Leverage Platform vendors prioritize feature requests from customers who might switch if their needs aren’t met. Captive customers often find their requests deprioritized in favor of net-new customer acquisition.

The Future Battlefield: AI and the Next Lock-in War

The AI Integration Trap

As artificial intelligence capabilities become central to data platforms, a new generation of lock-in strategies emerges.

Proprietary AI Models Each platform is developing specialized AI capabilities:

- Snowflake Cortex for natural language queries

- Databricks’ MLflow for model lifecycle management

- AWS SageMaker for integrated machine learning

These AI features create new dependencies that are even harder to migrate than traditional data workloads.

Training Data Hostage Situations Machine learning models trained on one platform often can’t easily transfer to another. The models themselves become a form of lock-in, especially for organizations with substantial ML investments.

AI-Optimized Hardware Specialized hardware optimizations for AI workloads create performance cliffs when migrating between platforms. A model that runs efficiently on Databricks’ GPU clusters might perform poorly on Snowflake’s architecture.

The Emerging Open Source Response

The open-source community is already preparing responses to AI-based lock-in:

MLOps Standardization Projects like Kubeflow and MLflow (now fully open-source) aim to create platform-agnostic machine learning workflows.

Open Model Formats ONNX and similar initiatives work to create universal model formats that can run on any platform.

Federated Learning Frameworks Technologies that enable model training across multiple platforms without centralizing data could fundamentally reshape the AI lock-in landscape.

Building Your Exit Strategy

The Three-Horizon Planning Model

Smart organizations plan for platform independence across multiple time horizons:

Horizon 1: Immediate Optimization (0-12 months)

- Audit existing vendor dependencies

- Identify quick wins for standardization

- Negotiate better terms using competitive intelligence

- Implement abstraction layers for new development

Horizon 2: Strategic Positioning (1-3 years)

- Migrate to open formats where feasible

- Develop multi-platform expertise within teams

- Create proof-of-concept implementations on alternative platforms

- Build internal tooling that abstracts vendor differences

Horizon 3: Platform Optionality (3+ years)

- Achieve true platform independence for core workloads

- Maintain active relationships with multiple vendors

- Leverage platform-specific features only where switching costs justify the benefits

- Continuously evaluate emerging alternatives

The Portfolio Approach

Rather than seeking a single “winner” platform, sophisticated organizations treat cloud vendors like investment portfolio components:

Core Holdings (60-70%) Primary platform for routine workloads where optimization and integration matter most. Choose based on team expertise and existing investments.

Growth Investments (20-30%) Secondary platform for experimentation and new use cases. Provides competitive leverage and hedge against primary platform risks.

Speculative Bets (5-10%) Emerging platforms and open-source alternatives. Small investments that could provide significant returns if they disrupt the market.

The Real Cost of Freedom

Making the Business Case

Platform independence isn’t free. Organizations must weigh the costs of flexibility against the benefits of optimization.

Quantifying Lock-in Risk

- Calculate potential switching costs as percentage of annual platform spend

- Assess pricing escalation risk based on vendor market position

- Evaluate feature development risk if vendor priorities shift

- Consider acquisition risk and resulting strategy changes

The Innovation Tax Platform-specific optimizations often deliver significant performance improvements. Organizations choosing portability may sacrifice 10-20% performance for strategic flexibility.

Operational Complexity Multi-platform strategies require additional operational overhead:

- Increased monitoring complexity

- Multiple vendor relationships to manage

- More complex disaster recovery planning

- Additional security considerations

When Lock-in Makes Sense

Vendor lock-in isn’t always negative. Sometimes the benefits justify the risks:

Rapid Time-to-Market Startups and fast-growing companies might prioritize speed over flexibility. Platform-specific optimizations can accelerate development and reduce operational complexity.

Deep Specialization Benefits Organizations with specialized use cases might benefit from platform-specific features that provide substantial competitive advantages.

Limited Technical Resources Small teams might lack the bandwidth to maintain platform independence. Accepting lock-in can free resources for core business development.

The Path Forward: Pragmatic Independence

The Balanced Approach

The goal isn’t to eliminate all vendor dependencies—it’s to make conscious, informed decisions about when lock-in provides sufficient value to justify the risks.

Strategic Assessment Framework For each platform decision, evaluate:

- Switching Cost Analysis: What would it cost to migrate in 1, 3, and 5 years?

- Competitive Advantage: Does platform-specific optimization provide meaningful business benefits?

- Risk Assessment: What happens if the vendor changes pricing, gets acquired, or discontinues features?

- Team Capability: Does your team have the skills to maintain alternatives?

Continuous Option Value Maintain small investments in alternative platforms to preserve switching options. The cost of keeping options open is often far less than the cost of creating them under pressure.

Building Institutional Memory

Organizations should document and preserve the knowledge needed for platform independence:

Architecture Decision Records Document why specific platform choices were made and under what conditions they should be reconsidered.

Migration Playbooks Maintain high-level migration plans for critical workloads, updated annually to reflect current architecture and vendor landscapes.

Vendor Relationship Management Track vendor interactions, pricing negotiations, and competitive intelligence to inform future decisions.

Key Takeaways

The Lock-in Reality All major cloud platforms use sophisticated strategies to increase switching costs. Recognizing these strategies is the first step toward maintaining strategic flexibility.

Options Have Value Platform independence capabilities have option value even when not exercised. The ability to credibly threaten switching provides negotiating leverage and insurance against vendor risk.

Open Standards Matter Investing in open formats and standards pays dividends in platform flexibility, even when using proprietary platforms for compute and optimization.

Balance is Key Pure platform independence often costs more than the risks justify. The goal is informed decision-making about when lock-in provides sufficient value.

AI Changes Everything The next generation of platform lock-in will center around AI capabilities. Organizations should prepare now for these emerging dependencies.

Team Skills Drive Strategy Your team’s platform expertise significantly influences optimal strategy. Build capabilities aligned with your independence goals.

The cloud vendor war isn’t ending—it’s evolving. As data becomes increasingly central to business success, the stakes will only rise. Organizations that understand these dynamics and plan accordingly will maintain strategic flexibility. Those that don’t risk finding their million-dollar data platforms transformed into golden handcuffs, beautiful but impossible to remove.

The choice is yours: remain a willing prisoner of convenience, or architect for the freedom to choose your own destiny. In the world of data platforms, independence isn’t just a technical architecture decision—it’s a business survival strategy.

Leave a Reply